Traders, risk managers and operation managers are challenged with the ability to utilize data that is streaming in rapidly from multiple external and internal sources. It is difficult to compare data, automate processes, and exchange data with legacy systems, like transaction processing system, treasury management system, risk and pricing engine.

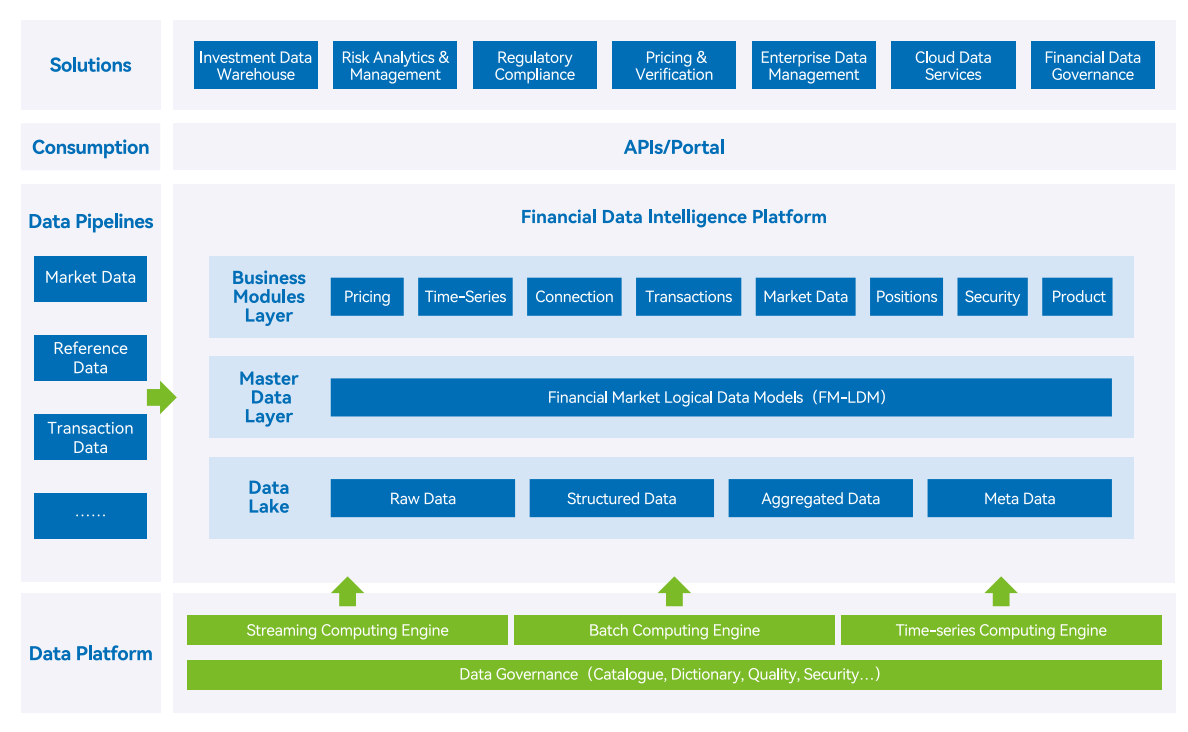

Our data platform integrates all types of data from order management system, risk engine or treasury system, captures the real-time data changes and maintain the data consistency from front office, middle office to back office.

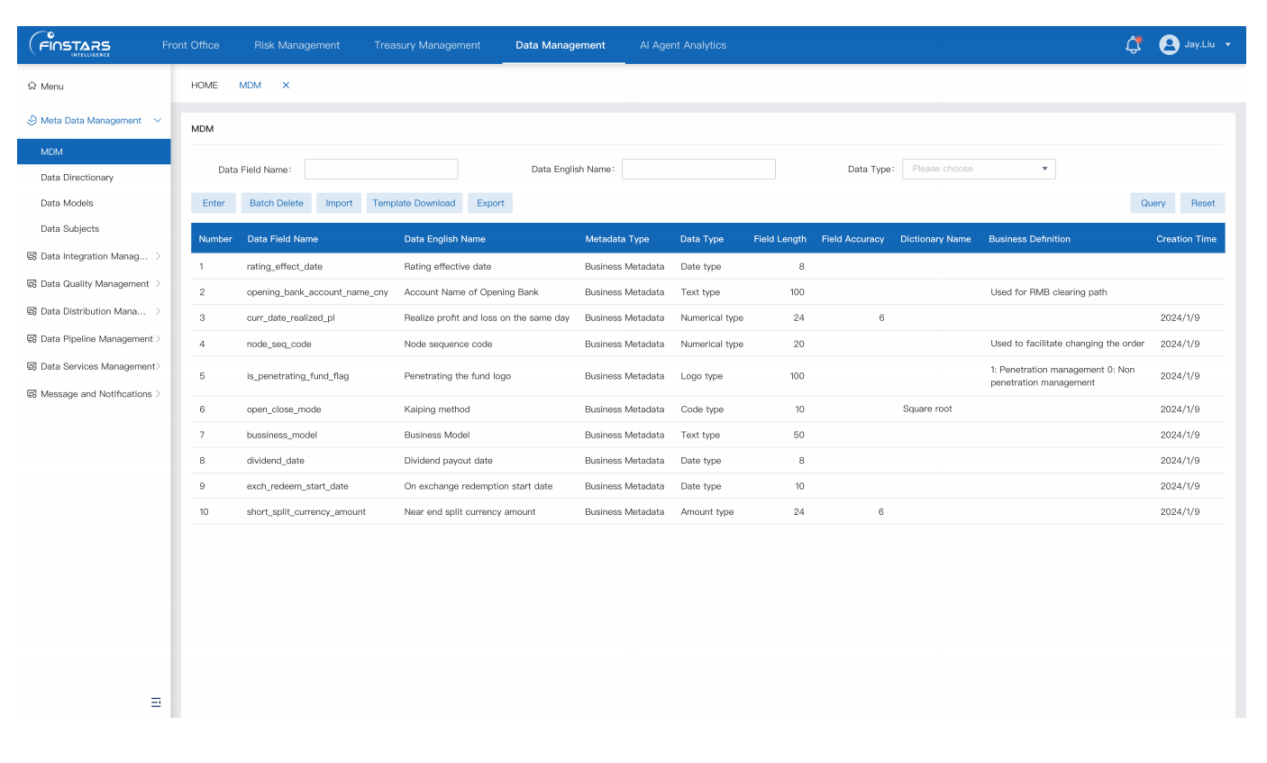

Finstars enterprise data management integrates and aggregates data automatically from transaction processing system or engine in real-time. It delivers the financial market data standard with financial market data model(FMDM), establishes clear definitions of the data itself to produce the metadata component for data governance. The solution provides clear defination about how to access the transaction data and market data for all asset classes.

The data-parallel computing architecture supports end-to-end data management for all treasury, trading and investment activities. It also can integrates various service-oriented business processing components to empower data-driven management decisions in financial markets sectors.

Get in touch

Unlock the potential of Data & AI in financial services

Copyright © Finstars Intelligence. All Rights Reserved