May 6-7, Kmerit Global attended the Dubai Fintech Summit.

The Dubai Fintech Summit was hosted by the Dubai International Financial Centre (DIFC) under the theme "Pioneering FinTech’s Future." More than 5,000 CEOs and experts from global banks, securities firms, asset management companies, exchanges, fintech companies, governments, and regulatory bodies participated in the summit. Over 100 fintech companies showcased their products and services, jointly exploring innovative technological advancements and challenges in the fintech sector.

At the summit, Kmerit Global, as a representative of global fintech companies, actively engaged with several UAE financial institutions and partners. The General Manager of Kmerit Global met with senior executives from Emirates NBD, the Dubai Financial Services Authority (DFSA), Dubai Islamic Bank, and Bank of China’s Dubai branch to discuss establishing long-term communication mechanisms and advancing fintech cooperation, laying a solid foundation for future business development in the Middle East region.

Main Venue of the Dubai Fintech Summit

In recent years, the fintech market in the Middle East and North Africa (MENA) has seen remarkable growth, with a proliferation of startups and venture capital firms. Statistics show that over 1,000 fintech startups have established headquarters in Dubai, with a total market value exceeding $15.5 billion.

Dubai is considered the primary financial center in the MENA region and its importance in the global financial system is growing. During the summit, Arif Amiri, CEO of the Dubai International Financial Centre (DIFC), stated that fintech is rapidly transforming financial services, with the cryptocurrency market reaching 2trillion in 2023;digital payment sare projected to reach 10 trillion by 2026.

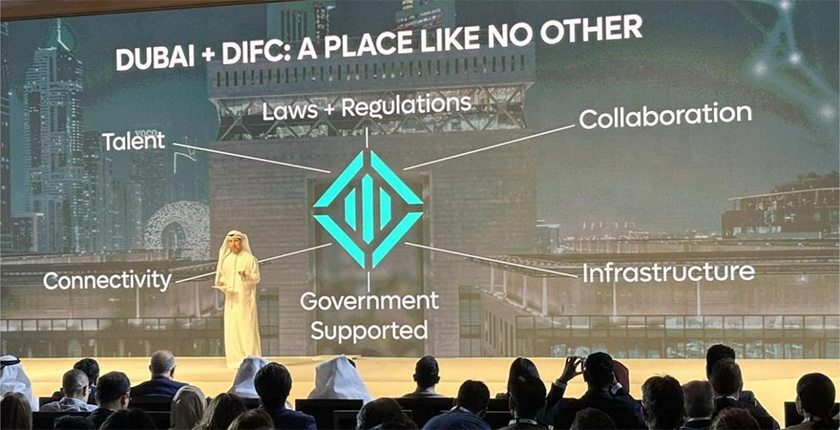

Address by the CEO of the Dubai International Financial Centre (DIFC)

Dubai and the DIFC will provide comprehensive support for fintech across six dimensions: talent, collaboration, connectivity, infrastructure, government support, and legal and regulatory frameworks. They aim to become a unique global hub for fintech development. Nearly 60% of Gulf Cooperation Council (GCC) fintech companies have their headquarters in Dubai, forming a global financial center with 5,500 financial enterprises, over 230 banks, more than 370 wealth and asset management companies, over 100 insurance institutions, around 600 family offices, and over 42,000 employees.

Nasdaq Chairman and CEO Adena T. Friedman mentioned that fintech and innovative technologies will reshape the future of financial markets. The rapid development of the Middle Eastern market is impressive, and Nasdaq plans to actively expand its presence in the region's financial markets through its fintech company, Adenza, which provides solutions for capital market investment management and risk management to global financial institutions.

Participation in Thematic Dialogue by Nasdaq CEO Adena T. Friedman

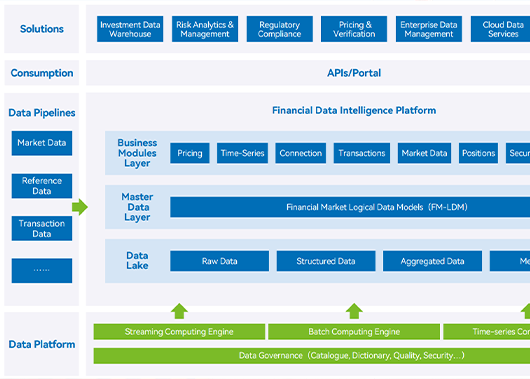

Since 2013, Kmerit Global has been focused on technology and product development in the capital and money markets. In 2023, the company began perfecting its global market layout, aiming to become a leading digital technology company in the financial markets. It provides one-stop solutions for capital market investment management, risk management, and data intelligence infrastructure for global financial institutions. Looking ahead, we look forward to establishing close relationships with financial institutions and regulators in the MENA region to contribute to the development of global fintech.

Get in touch

Unlock the potential of Data & AI in financial services

Copyright © Finstars Intelligence. All Rights Reserved