On October 21st, the Sibos Annual Conference ("Sibos 2024 Conference"), organized by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), opened in Beijing. This is the first time that the Sibos Annual Conference has been held in mainland China since its 44th edition. Finstars attended as a representative enterprise of financial technology.

Financial supervision and inter-bank infrastructure institutions such as the People's Bank of China, China Foreign Exchange Trading Center, Cross border Interbank Payment and Clearing Corporation (CIPS), Shanghai Clearing House, and the Central treasury bond Registration and Clearing Corporation attended the meeting. Industrial and Commercial Bank of China, Construction Bank, Agricultural Bank of China, Bank of China, Bank of Communications, Hong Kong Monetary Authority, Hong Kong Stock Exchange, European Central Bank, HSBC Group, J.P. Morgan, Bank of America, BNP Paribas, UBS, DBS Bank, Deutsche Bank, Mizuho Group of Japan, ANZ Bank, Royal Bank of Canada, Visa, Mastercard and other major global financial institutions and organizations participated in this annual meeting.

This annual conference also features major global fintech companies and international consulting firms such as Nasdaq, Finastra, Murex, FIS, IBM, Oracle, EY, KPMG, Bloomberg, etc., to jointly explore cutting-edge technology directions in payment clearing, corporate credit, artificial intelligence applications in core banks, data analysis, trading and risk.

As a leading bank and capital market financial technology representative enterprise, Finstars had in-depth exchanges with cross-border payment and clearing companies, Bank Mandiri of Indonesia, Aktif Bank of Türkiye, Abu Dhabi First Bank (FAB) of the United Arab Emirates, RaboBank of the Netherlands, National Bank of Vietnam, Dibai International Financial Center (DIFC), Fugang Bank and other financial institutions during the meeting, and discussed cooperation opportunities in the fields of capital and capital markets, data intelligence, and cross-border digital finance.

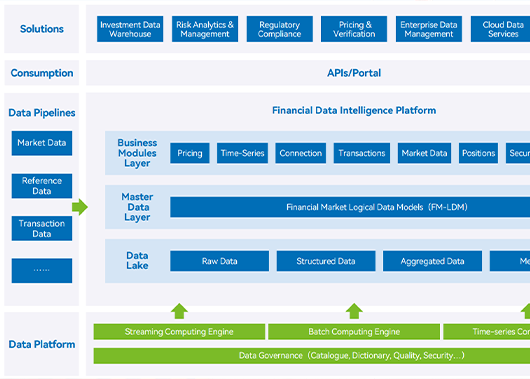

Finstars has long been deeply committed to using data intelligence technology to promote the digital transformation of cross asset trading, risk management, and back-end clearing. It has internationally leading financial engineering and product development capabilities in financial risk measurement, asset valuation and pricing, and model validation. In recent years, it has been using AI big models and Agent intelligent agent technology to assist in transaction processing, financial measurement, and real-time data analysis, and has launched a new generation of intelligent fund and risk management solutions.

Get in touch

Unlock the potential of Data & AI in financial services

Copyright © Finstars Intelligence. All Rights Reserved